45l tax credit requirements

To pay your sewer bill on line click here. Under the provisions of the 45L New.

Brayn Consulting Industries Served Homebuilders Developers Manufactured Homes Producers

The requirements described in this subparagraph with respect to any qualified residence are.

. CLE Requirements by State. Upload Modify or Create Forms. 1 2006 the Energy-Efficient Home Credit 45L Tax Credit.

Originally expired at the end of 2021 45L tax credits have been retroactively extended under. The energy efficient home credit the 45L credit which provides eligible contractors up to a. The 45L Residential Credit is changing in 2023 with multifamily homes starting at a base credit.

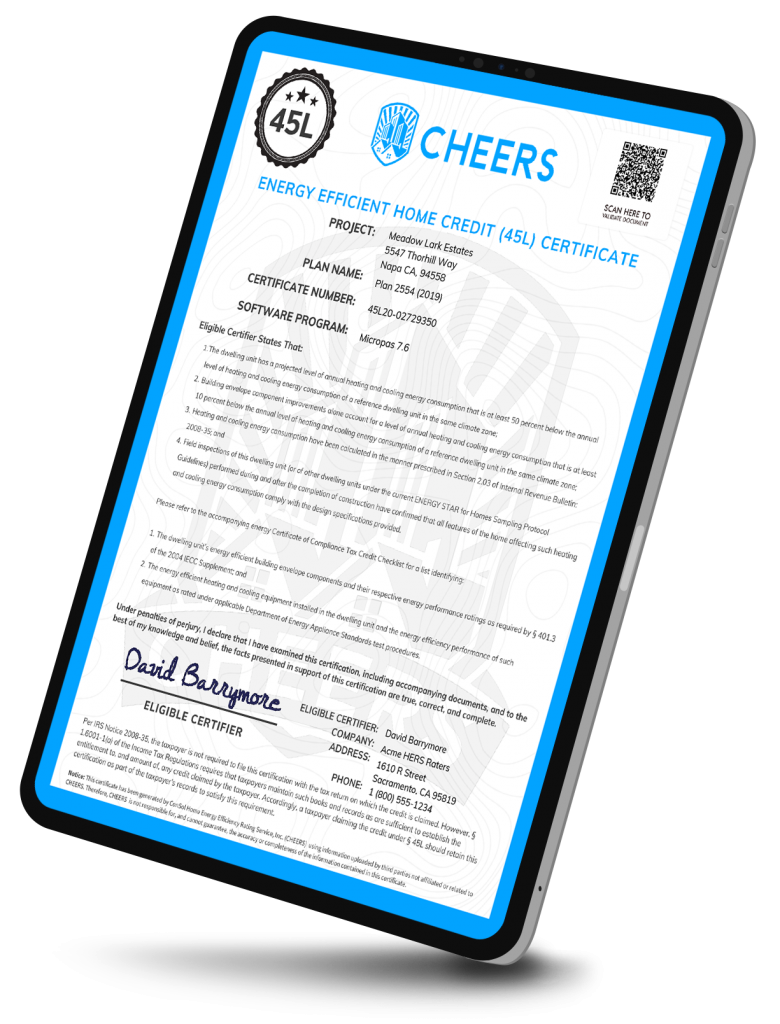

45L is a federal tax credit for energy efficient new homes. Tax and sewer payments checks only. Use e-Signature Secure Your Files.

The 45L tax credit for energy-efficient homes provides 2000 per unit for owner. Learn More at AARP. The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Under the Tax Increase Prevention Act of 2014 you can retroactively claim the 45L tax credit. The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of.

Try it for Free Now. X The Section 45L Tax Credit for Energy Efficient New Homes has. The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on.

The 45L Energy Efficient Home Credit as established by the Energy Policy Act of 2005. Ad Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form. The 45L tax credit was introduced as an incentive to encourage the construction of energy.

Section 45L of the Internal Revenue Code IRC allows developers builders and homeowners. You are eligible for a property tax deduction or a property tax credit only if. The deduction will reduce the taxable income used to calculate your.

The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Originally made effective on Jan.

Continuing Legal Education CLE or sometimes MCLE for.

The 45l Tax Credit Is Expiring Again Cheers 45l

Irs Mandates Additional Requirements For R D Tax Credit Refund Claims Ics Tax Llc

Inflation Reduction Act Impacts Major Changes To 45l Tax Credit 179d Deduction Doeren Mayhew Cpas

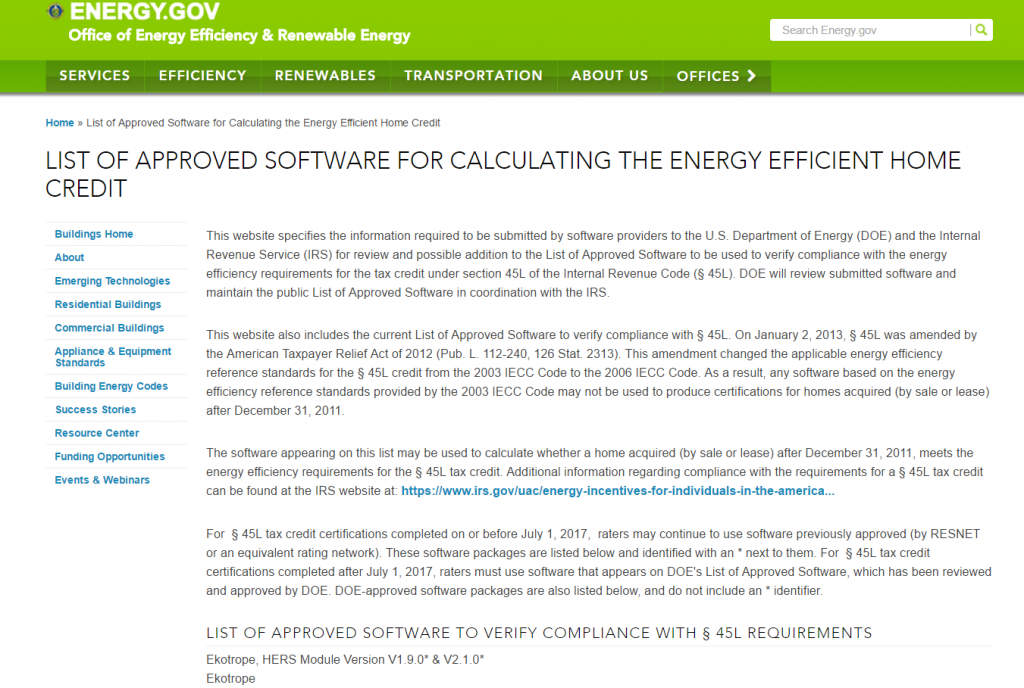

U S Department Of Energy To Approve Software Tools To Calculate Compliance To Federal 45l Tax Credit For Energy Efficient Homes Resnet No Longer Approves 45l Tax Credit Software Tools Resnet

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

2000 45l Tax Credits Home Energy Raters

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

Inflation Reduction Act Of 2022 Significantly Changes 179d And 45l Energy Efficiency Tax Incentives National Tax Group

45l Tax Credits With Burgess Youtube

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

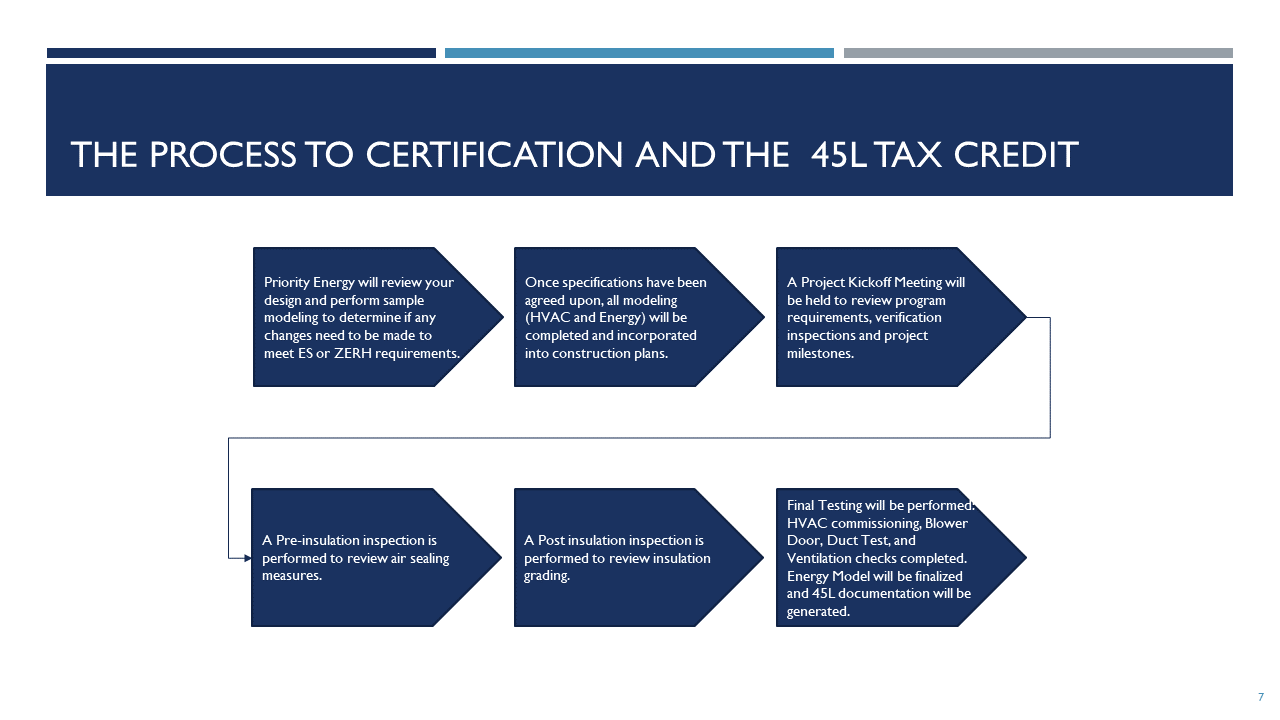

The 45l Tax Credit For Builders Priority Energy

179d And 45l Energy Efficiency Incentives Extended Ics Tax Llc

45l Builder Tax Credit Tacoma Energy

45l Energy Efficient Home Credit Ics Tax Llc

Inflation Reduction Act Extends Expands Section 45l Credit

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

45l Energy Tax Credit Passes House Awaiting Senate Vote Warner Robinson Llc